“While I may not be as technically or creatively competent as Cobie to wield the chalice of bourgeois-laced words or possess the industry insight required to craft such an analytical piece on the behavioral side of the crypto-verse, my intent is to create a simpler sequel—one for those who may feel lost or would prefer an easier way to digest such rich content.”

What is the Metagame?

The article breaks it down into two (2) - The Meta and the Metagame. Cobie conceptualizes the meta as a gaming phenomenon.

He draws his insight from the psychology of a gamer and the game itself, wherein the game developer intends to create an ever-increasing high level of complexity or “difficulty” to sustain the enthusiasm of the player.

Picture it as playing an arcade game and going on missions. With each completed mission, the player gets a bit better at understanding the technicalities of the game such as knowing which characters are best efficient for certain stages of the game (Weaker and stronger characters).

As the player acquires more understanding of the game and formulates, learns, or acquires the Meta to each stage, the game generally becomes much easier to navigate.

The player can and will use the meta to defeat each stage applying this concept i.e; making use of the stronger or most efficient characters where necessary.

Simpler analysis of the metagame in crypto:

To align this analogy with crypto, we need to unpack Cobie’s view that identifying the meta is itself the metagame.

It’s important to note that the crypto industry is still in its formative years. New ideas emerge daily, some are revolutionary, others are simply cash grabs. Identifying the meta can bring great reward but also great risk. Success in the crypto market often depends on one’s ability to separate technically sound projects from noise.

Take Cobie’s “SoLunAvax” example—an acronym for Solana, Luna, and Avalanche. These are alternative smart contract platforms to Ethereum. Ethereum’s limitations as a Layer 1 chain sparked the emergence of these alternatives. Just as developers seek easier programming languages, the crypto world builds on existing tech—forking it, modifying it, or expanding its core ideas.

Naturally, these alternative chains launched with their own tokens. Those who understood the meta, acted on it, and got in early, whether by trading, investing, or holding Sol, Luna, or Avax, reaped the benefits.

As each of these chains succeeded, a new meta emerged: the next logical move was to ride the wave of products being built on these chains, just as earlier builders had done on Ethereum, or to bet on newer alternatives.

My Classification of Meta-Actions

I classify meta-actions into three categories:

Negative SuperMeta – Market direction driven by a project’s failure or inherent flaws.

Positive SuperMeta – Market direction driven by a project’s success or strong fundamentals.

Sub-Meta – Market trends that emerge in response to either of the above.

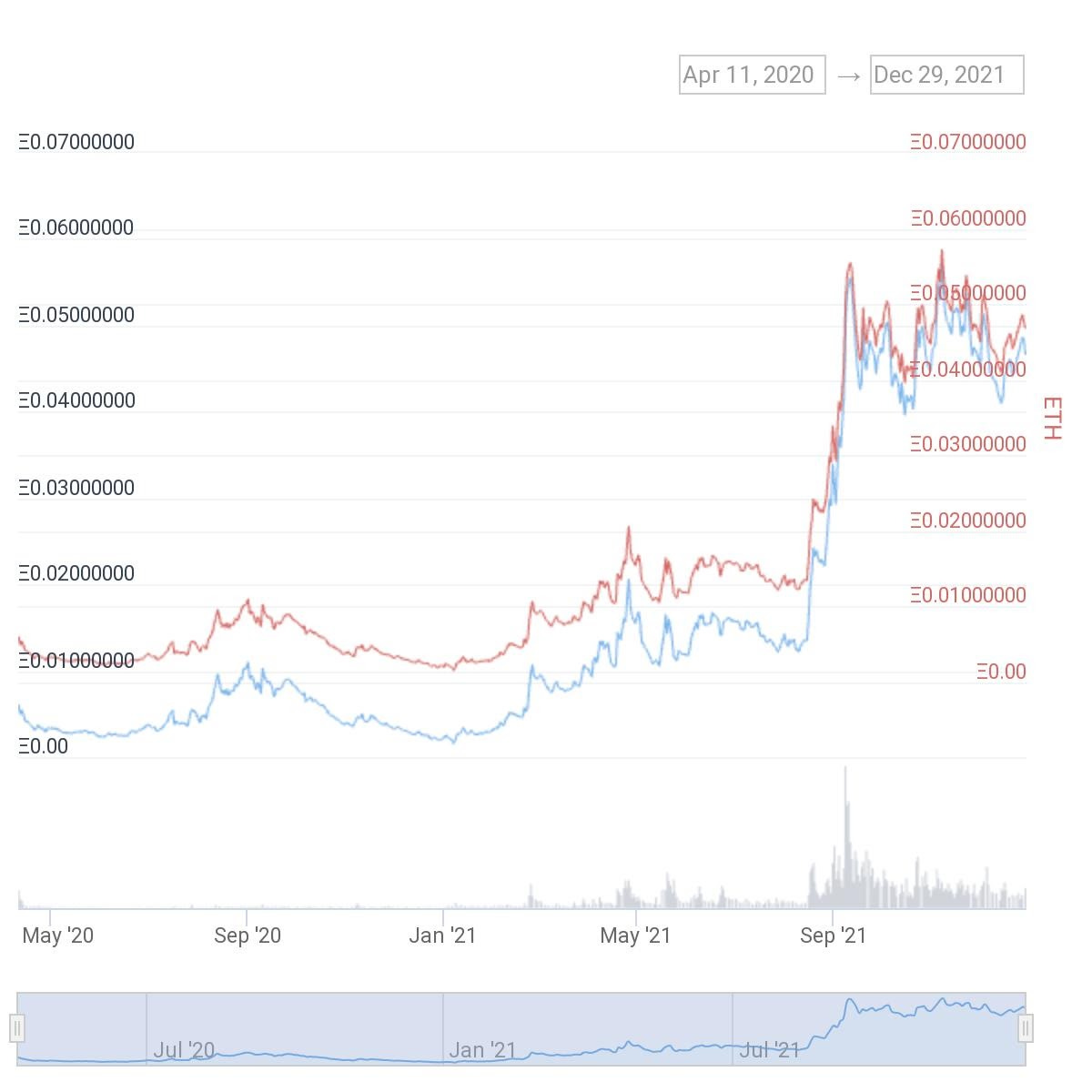

Example: Sol/Eth and Avax/Eth price action from April 11, 2020 to December 29, 2021, and September 3, 2020 to January 3, 2022.

Sol/Eth and Avax/Eth price action Apr 11th, 2020- 29th Dec 2021 and Sept 3rd, 2020 - Jan 3rd, 2022.

The Dynamism of Metas and the Economics of Attenttion:

Metas are dynamic by nature—this fluidity mirrors the ever-changing crypto markets. Cobie describes this dynamism as “fleeting and unsustainable,” especially within the NFT space. The rise of projects like BAYC and CryptoPunks triggered a wave of NFT hype, where everyone was trying to create “the next big thing.” Many of these projects failed, leaving buyers “rekt.”

As someone who got rekt chasing blue-chip NFTs in search of Valhalla, I understand the psychology—what Cobie rightly calls FOMO.

Here, the concept of the economics of attention becomes crucial. In crypto, attention spans are short. What’s hot today might be forgotten tomorrow. This makes it difficult to identify the meta early enough to benefit from it.

Despite that, the NFT metagame shows that early adopters weren’t always the only winners. Take MAYC (Mutant Ape Yacht Club), for instance, spawned from BAYC and reaching a significant 10 ETH floor at the time this was written. So, success in a metagame isn’t just about being early. Other factors, like community strength, influencer support, and sustained attention, play major roles.

In this space, attention is a valuable commodity. Projects with long-term, positive attention have a higher chance of success. Metas are often attention magnets, but when too much attention builds too quickly, the market response is often negative. This raises the key question:

How do we identify metas before they’re saturated by attention economics?

Identifying the Meta - Are Reward Tokens the New Metagame?

Cobie’s piece was an eye-opener, it showed that a metagame is always at play in crypto. Whether it stems from a project’s success, failure, or ripple effect (sub-meta), identifying and leveraging it is what matters.

From an observational point of view, the best way to spot a metagame is through research and a deep understanding of industry trends. Ask yourself: What’s next? Where’s it going? What’s trying to improve on what already exists?

“DYOR” (Do Your Own Research) is as old as crypto itself and never goes out of style. While following thought leaders on Crypto Twitter (CT) can be insightful, many are profit-driven and will “shill” projects only to dump them. Still, genuine insights often emerge from conversations between credible accounts—so staying plugged in is worthwhile.

To profit from a metagame, you need to be early. If it’s already viral, chances are you’re just exit liquidity for someone else.

So, are “reward tokens” the new metagame?

My answer: a resounding No.

While the trend of airdropping tokens like $SOS as rewards for participation in crypto activities may feel exciting and increasingly common, it doesn’t quite qualify as a metagame. It’s more of a marketing gimmick, effective in the short term, grabbing attention and briefly enriching users, but it lacks the mystery and depth typically associated with a real metagame. It’s already exposed.

Finding the metagame isn’t about waiting for crypto “Christmas” to drop from the sky. It’s about paying attention to the seemingly inconsequential, understanding the bigger picture, and being intentional.

Final Thoughts

This isn’t a pro tip—it’s a caution. You will likely lose money trying to identify a metagame on your own or betting too early on something you’re convinced is the next big wave.

If you’re a noob, try to observe more than you jump in. That patience and awareness could save you from making grave mistakes.